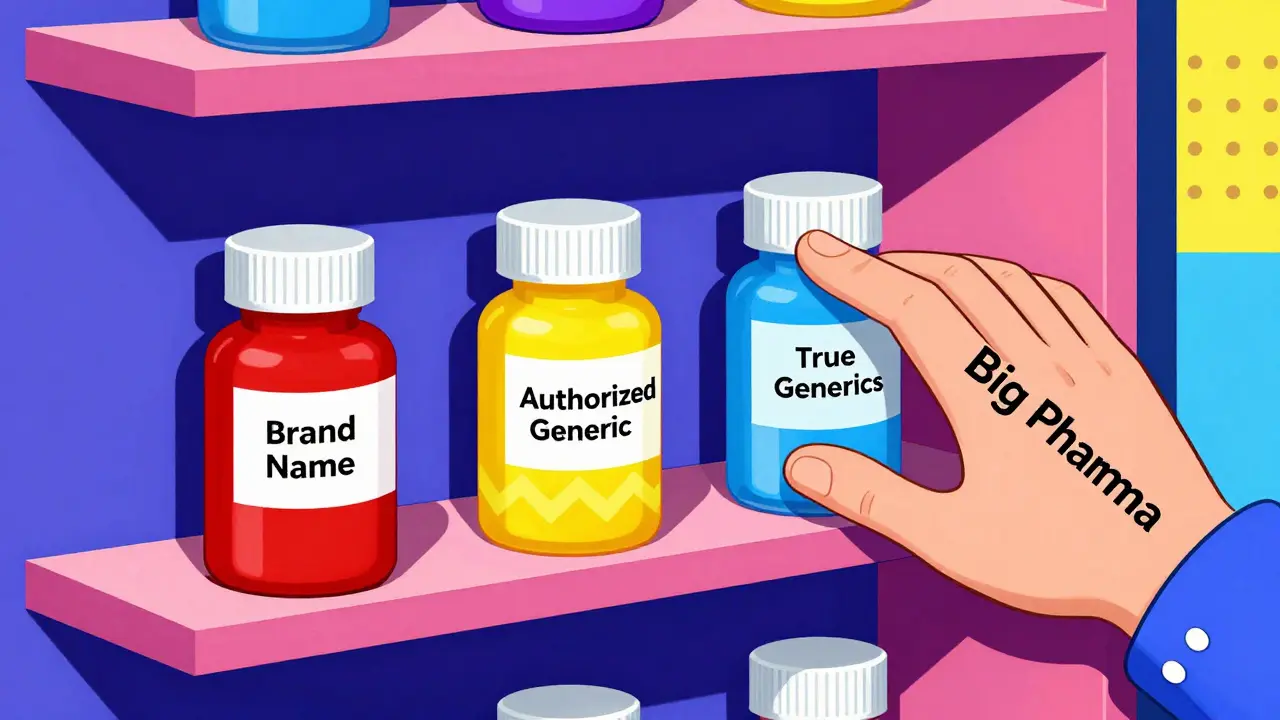

When a brand-name drug’s patent is about to expire, the promise of cheaper generic versions kicks in. Patients expect lower prices. Pharmacies expect more options. But in many cases, the first generic to hit the market doesn’t get the full benefit of its hard-won 180-day exclusivity. Why? Because the same company that made the brand-name drug launches its own version-called an authorized generic-right alongside it.

What Exactly Is an Authorized Generic?

An authorized generic isn’t a copycat. It’s the exact same pill, capsule, or injection as the brand-name drug, just repackaged with a generic label and sold under a different name. It’s made by the original manufacturer, or licensed to a subsidiary, and hits shelves with no new FDA review. No new clinical trials. No new data. Just a new label. This isn’t some loophole. It’s legal under the Hatch-Waxman Act of 1984, which was meant to speed up generic access. But here’s the twist: the law gives the first generic company that challenges a patent a 180-day window to be the only generic on the market. That’s their reward for risking millions in legal fees. But if the brand company launches its own generic during that window, it shatters that exclusivity.How Authorized Generics Disrupt the Market

Think of it like this: you’re the first person to open a coffee shop in a new neighborhood. You’ve got the only location. For six months, you’re the only game in town. Then, your biggest competitor-someone who owns the original coffee brand-opens another shop right next door, selling the exact same beans, same brew, same price. Only now, they call it “Brand Coffee (Generic).” That’s what happens with authorized generics. The first generic company expected to capture 80-90% of the generic market during its exclusivity period. Instead, they often get stuck with 50% or less. The FTC found that when an authorized generic enters, the first-filer’s revenue drops by 40-52% during those 180 days. And the damage doesn’t stop there. In the next 30 months, their revenue stays 53-62% lower than it would’ve been without the authorized generic. Why? Because consumers don’t always go for the cheapest option. The authorized generic is priced lower than the brand-name drug-but higher than the true generic. So now there are three tiers: brand (highest), authorized generic (middle), and independent generic (lowest). Many patients, especially those on insurance, get the middle-tier version because it’s still covered under the brand’s formulary. The real generic? It gets buried.The Hidden Deal: Reverse Payments and Secret Agreements

Here’s where it gets darker. In many cases, the brand company doesn’t just launch an authorized generic. They pay the first generic company to delay entering the market at all. This is called a “reverse payment” settlement. Between 2004 and 2010, about 25% of patent settlements involving first-filing generics included a promise: “We won’t launch our authorized generic if you delay your generic by three years.” These deals weren’t public. They were buried in legal documents. The total value of drugs affected? Over $23 billion. The result? Instead of generic competition starting right after patent expiry, patients waited an extra 37.9 months on average. That’s over three years of higher prices. The FTC called these arrangements “the most egregious form of anti-competitive behavior in the pharmaceutical sector.” In 2013, the Supreme Court ruled in FTC v. Actavis that reverse payments could violate antitrust law-but it didn’t specifically ban authorized generics. So companies kept doing it, just with more careful wording.

Who Wins? Who Loses?

The brand companies win. They keep market share. They keep pricing power. They turn the generic market into a controlled extension of their own brand. The first generic companies lose. They spend millions to challenge a patent, only to see their reward stolen. Teva Pharmaceutical reported a $275 million revenue shortfall in one year just from authorized generic competition on key drugs. Patients lose too. Even though authorized generics are technically cheaper than the brand, they’re not as cheap as true generics. And when the first generic can’t make money, fewer companies will risk challenging patents in the future. The Congressional Research Service found that for low-sales drugs-those making $12-27 million a year-authorized generics make generic challenges less likely. That means fewer competitors down the line. Pharmacy benefit managers (PBMs), who negotiate drug prices for insurers, are split. About 68% say they prefer formularies that include authorized generics because they offer more pricing flexibility. But that’s because they’re playing the system, not because it’s better for patients. It’s a business decision, not a health one.Regulators Are Fighting Back

The FTC has been pushing back hard since 2011. Their reports show clear harm. They’ve opened 17 investigations since 2020 into suspicious authorized generic deals. In 2022, they made it clear: “We will challenge any arrangement that uses authorized generics to circumvent the competitive structure Congress established in Hatch-Waxman.” Congress has tried to fix this too. The Preserve Access to Affordable Generics Act has been introduced multiple times-most recently in March 2023. It would make it illegal to agree not to launch an authorized generic in exchange for delayed generic entry. But it keeps getting stalled. Meanwhile, the industry fights back. PhRMA, the big pharma lobby, argues that authorized generics increase competition. They cite a 2024 study saying pharmacies paid 13-18% less when authorized generics were available. But that ignores the bigger picture: those savings come at the cost of crushing the only company legally allowed to be the first real competitor.

Is This Practice Declining?

Yes-but not because it’s fair. It’s declining because regulators are watching. In 2010, nearly 42% of markets with first-filer exclusivity saw an authorized generic enter. By 2022, that number dropped to 28%. A 2023 study in JAMA Internal Medicine found that authorized generics were significantly less likely to launch after patent settlements. Companies are learning that the legal risk isn’t worth it anymore. Still, they haven’t stopped. Some now use third-party licensees to make the authorized generic look “independent.” Others delay launch until the last possible day of exclusivity. Some even wait until after exclusivity ends, then undercut the true generic with aggressive pricing. The Hatch-Waxman Act never imagined this. It was designed to get generics to market fast. Instead, it gave brand companies a legal tool to keep control.What’s Next?

The system is still broken. Authorized generics aren’t evil in theory. If a brand company launched a true generic at a deep discount right after patent expiry, patients would benefit. But that’s not what’s happening. What’s happening is a sophisticated, legal way to maintain monopoly pricing while pretending to support competition. Until Congress closes the loophole-or the FTC successfully blocks more deals-patients will keep paying more than they should. The first generic company will keep losing. And the brand companies will keep playing the game. The real question isn’t whether authorized generics are legal. It’s whether they’re ethical. And if they’re hurting competition, why are they still allowed?Are authorized generics the same as regular generics?

Yes, in terms of ingredients, dosage, and effectiveness. Authorized generics are chemically identical to the brand-name drug. The only difference is the label and who makes it. Regular generics are made by independent companies after successfully challenging the patent. Authorized generics are made by the original brand company or a company it licenses.

Why do brand companies launch authorized generics?

To protect their market share. When a generic enters, prices usually drop 80-90%. But if the brand company launches its own generic, it captures part of that market without lowering prices as much. This reduces the financial reward for the first generic company, discouraging future patent challenges and keeping overall drug prices higher.

Do authorized generics lower drug prices for consumers?

Sometimes, but not always. Authorized generics are cheaper than the brand-name version, but they’re often priced higher than true generics. This creates a middle tier that can delay the full price drop. In some cases, they help bring down prices faster. In others, they prevent true generics from gaining traction, which keeps prices higher long-term.

Is it legal for a brand company to launch an authorized generic during a generic’s exclusivity period?

Yes. The FDA and courts have consistently ruled that the Hatch-Waxman Act does not prohibit branded manufacturers from launching their own authorized generics during the 180-day exclusivity period granted to the first generic filer. However, if the brand company pays the generic company to delay entry or avoid launching, that may violate antitrust laws.

What’s being done to stop anti-competitive authorized generic practices?

The FTC is actively investigating agreements that delay authorized generic entry. Congress has proposed the Preserve Access to Affordable Generics and Biosimilars Act, which would ban deals where a brand company agrees not to launch an authorized generic in exchange for the generic company delaying market entry. So far, these bills haven’t passed, but enforcement actions are increasing.

2 Comments

Chloe Hadland

January 22, 2026 AT 20:23i just saw my prescription price drop by 60% last month and thought wow generics are working

then i realized it was an authorized generic and my insurance still paid more than it should

Amelia Williams

January 23, 2026 AT 20:21this is such a classic corporate play

they make you think you're winning with lower prices but really they're just rearranging the deck chairs on the Titanic

patients get a tiny discount while the real competition gets strangled before it even starts